NEWS

[REPORT] Energy prices will rise

From the beginning of 2015 through the end of 2017, the price of the next year’s black energy purchased on the stock exchange fluctuated but stayed within a fairly constrained range of approximately 152 – 186 PLN per MwH. In 2018, the electricity market began a ‘new normal,’ increasing gradually in the first quarter before climbing more dramatically starting in April. By September, the price for 2020 contracts was approaching 320 PLN. The price for 2020 subsequently dropped back a bit, but has stayed within a range of 250-285 PLN for the past several months – a 100 złoty (or 53-64%) increase per MwH over the “bargain” period of the previous three years.

Several industry experts had been predicting increases in energy prices in Poland for some time, but the rapidity of the mid-2018 increase caught even some of these experts by surprise. It is not quite black swan territory, but the energy landscape has definitely changed, and changed dramatically. How then did we end up here? In this brief report, we will examine the primary factors behind the price increases. We will admittedly present these elements somewhat superficially. Any one of them could be the subject for a fully detailed article of its own. But our goal here is to present the big picture with an eye towards understanding where we might be in the coming months… or years.

EUROPEAN CO2 LAWS

The European Union has a rigorous initiative in place to cut its greenhouse gas emissions substantially, with the goal to reduce emission levels by 20% in 2020 compared with 1990 levels. A follow-on goal seeks at least a 40% reduction by 2030. It is a major element of the EU’s energy policy, and all of its member countries, including Poland, are obliged to adhere to the guidelines. To assist in helping the market achieve the goals more naturally, the EU put into place an emissions trading system (EU ETS). CO2 producers receive allowances for emissions, either by getting them for free or purchasing them via auction on the EU ETS. Reduce your emissions, and you can sell your allowances via the system. Exceed your allowances, and you must purchase more. Since approximately 80% of Poland’s electricity comes from the burning of coal, Poland’s electricity producers are active purchasers in the auction system.

Beginning in August, 2017, the cost of an allowance for one ton of carbon emission was around 6 EUR. From then, throughout 2018, and into 2019, the allowance cost increased approximately fourfold, topping out at nearly 27 EUR per ton in April, 2019, by far the highest level since 2008. There has been direct causality between the increase in carbon emission costs and the electricity prices for end users. And the consequences may have been understated thus far. Previously, Poland had surplus CO2 certificates and, as noted above, some producers received them for free. Now, all certificates must be purchased via the EU ETS, so the impact on pricing for consumers will be more intense.

One must remember that the EU ETS is a political tool used to help achieve the climate change goals. And it is structured in a way that the total number of emissions allowances are decreased by 1.74% annually through 2020, and by 2.2% each year thereafter. In other words, there is a built-in mechanism which encourages these allowances to become more expensive. Estimates of the prices of the allowances for the next 3 years range from maintaining the current levels to 30 EUR, and we were unable to find any official estimates prognosticating decreases. And the longer-term estimates run much higher. Even the slightest increase in CO2 puts upward pressure on Poland’s electricity pricing.

PRICE OF COAL PRODUCTION

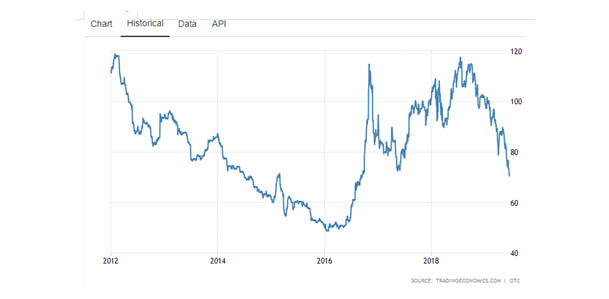

The average worldwide price of coal rose consistently, and often sharply, from mid-2016, when it was slightly over 50 USD per ton, before reaching a peak of just under 120 USD in the summer of 2018. At that peak, it was the highest price since 2012. Again, with more than 80% of Poland’s electricity needs supplied by coal, a more than doubling of the coal price should translate into higher electricity prices. And it did.

Since then, the worldwide coal price has fallen back quite a bit. As of early June, 2019, it is below 80 USD per ton, levels not seen since the end of 2017. Under normal circumstances, this should provide some hope of relief from higher electricity prices. Or if not lower prices, at least stability.

However, in Poland, the use of coal does not fall into the ‘normal circumstances’ category. Challenging mining and geological conditions in some of the mines, decreasing production levels and quickly aging infrastructure (including plants that require significant upgrades), among other issues, all contribute to a high cost of coal usage in Poland. Roughly 100,000 people currently work in the coal industry. And they are united, thus comprising a powerful political force. To wit, there are 460 seats in the lower chamber of Poland’s parliament; more than one hundred of them are represented by politicians from the coal-producing regions. As a result, politicos must cater to that group in order to avoid losing significant support in the elections (and this applies to all parties). Presented differently, the human resource costs in the coal industry should not be expected to decline. Moreover, Poland’s focus on energy security as a priority means the support for domestic coal will not decline in the near future. Polish coal, even with its challenges, is predictable, controllable, and minimizes energy dependence on Russia. There may be other energy resources down the road – growth in renewables, a potential nuclear option, a shift to more natural gas, etc. – but coal usage is not going away for a while.

Referring to the previous section in this article, this ongoing reliance on coal also means the cost of the carbon certificates will continue to be an ongoing factor.

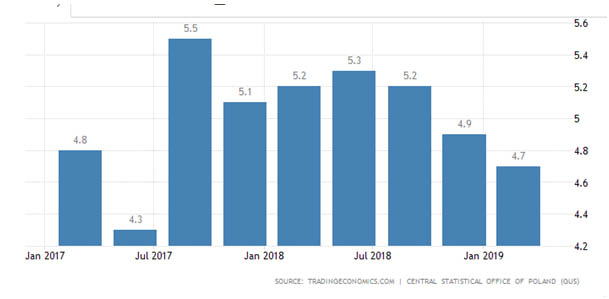

POLAND’S IMPRESSIVE ECONOMIC GROWTH

On June 12, articles appeared in the media announcing record-setting electricity demand** in Warsaw and nationwide (**to be precise, record-setting for this time of year). Poland’s electricity consumption has been growing approximately 2% per year in recent times. Demand for electricity is not expected to slow down any time soon in a country that was ranked in the top 15 worldwide for GDP growth per capita between 1990 and 2015. And the GDP growth has been especially strong over the past two years, with GDP year-on-year growth averaging approximately 5% in each quarter from Q1 2017 through today. [Note: Many studies have been conducted on the relationship between electricity consumption and economic growth over the last two decades. Most of these studies demonstrate at least a strong connection between the two, with some even going so far as to note causality from economic growth to energy consumption (including a report based in Poland and measuring data from 2000 to 2012).]

This is not to say that the economic growth will directly cause prices to increase, but it is hard for us to see downward pressure on pricing if the demand for electricity continues to rise so steadily. Rather, it is Poland’s dependency on coal that suggests the economic growth will result in higher prices (for the reasons mentioned above). While Poland has a plan to become less reliant on coal, it is decidedly long-term. In the meantime, renewable sources are still in the infancy stage here – in general, growing, albeit without enthusiastic government support, and not yet impactful. Without a drastic modification of Poland’s green-energy strategy, or truly open borders for electricity purchases, coal will be the primary electricity source. We expect the prices to react accordingly.

RECOMMENDATION

The sum is often greater than the parts. It is possible the overall electricity pricing picture may include some factors we are not aware of (the apparent court cases on market speculation come to mind). But the parts here are strongly suggesting increasing electricity prices in the medium term.

A good case could also be made that some of the government policies have kept end-user prices artificially low. The on-again-off-again law which was publicized at the end of 2018 and, as of the day of this writing, still has yet to be finalized, sought to keep prices at June 2018 levels. While we understand the motivation behind the government’s initiative, we do not believe it is a tenable approach for any meaningful length of time. In its current incarnation, the law would remove the pricing restraints for medium- and large-sized commercial entities while keeping the fixed prices in place for private consumers and small businesses. One option we anticipate in that case is that electricity prices for the commercial clients will jump in order to compensate for the potential losses the electricity producers could take in the residential market.

As such, we are recommending to our clients to buy in advance for next year, monitoring the market closely and taking advantage of any short-term dips in pricing. And we are eating our own cooking, having just locked in our full-portfolio electricity purchases for 2020 and in the process of moving forward with 2021 as well.

Address for correspondence

Plus Energia sp. z o.o.

Grochowska 312,

03-839 Warszawa